Theta Network (THETA) took one of the front seats in total value locked during the month of February.

The blockchain protocol that provides an end-to-end infrastructure for decentralized video streaming and delivery, experienced a 122% increase in total value locked (TVL).

While February proved to be a difficult month for several blockchain protocols, Theta Network was one of the few chains that experienced massive growths in liquidity locked into its ecosystem. By the end of the month, the network’s total value locked in at $212 million, according to Be[In]Crypto Research.

Although this figure does not seem impressive in comparison to the billions of dollars in TVL held by blockchains such as Ethereum, Terra, and Binance Smart Chain (BSC) – Theta Network’s total value locked for February was up $121 million compared to January 2022, a 133% increase.

Within 20 days, THETA sees a 2,879% spike

Although data on the Theta Network is relatively difficult to come across, statistical figures for TVL in the project began in January 2022. The addition of smart contract capability in July 2021 which coincided with the launch of the Mainnet 3.0 made the protocol one of the go-to ecosystems for the building of innovative dApps.

Just eleven days into January 2022, TVL in Theta was already at $3 million. Within 20 days, there was a 2,879% spike in TVL, closing out January at $90 million.

Overnight, Theta Network increased by 5% in TVL, starting February in a strong position.

TVL surpasses $260M in February

Although several projects took a hit in February due to the effects of the ongoing Russia-Ukraine conflict, as well as tensions surrounding a negative crypto market sentiment, the single – day high on TVL for February is still 13% higher than TVL as of press time.

While it’s TVL reached an all-time high of $261.84 million, it currently sits at $231.32 million as of press time.

Aside from Palm and Eos, Theta Network continues to surpass popular projects Terra (LUNA), Cardano (ADA), Tron (TRX), Tezos (XTZ), Algorand (ALGO), Binance Smart Chain (BSC), Ethereum (ETH), Solana (SOL), and Polygon (MATIC) in monthly percentage change with approximately 140%.

ThetaSwap and ThetaCash to thank?

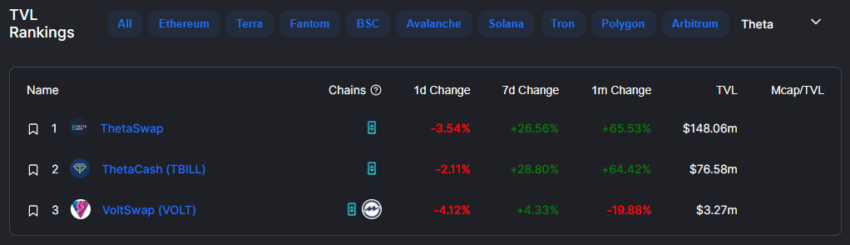

Projects on the network protocol that have contributed massively to the valuation are ThetaSwap and ThetaCash, with ThetaSwap serving as one the top 10 decentralized exchanges by TVL growth in February, according to Be[In]Crypto Research.

In mid-February, Theta Network announced its Theta Hackathon via Twitter. Developers continue to submit projects under the video, gaming/metaverse, NFTs/ThetaPass, and DeFi categories. The extensive development of decentralized finance products should add more liquidity to the total value locked currently in the Theta Network.

Ultimately, from January 11 ($3,048) and February 17’s ATH TVL of $261,840, Theta Network has seen an 8,000%+ increase in total value locked.

What do you think about this subject? Write to us and tell us!

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.